Condo Insurance in and around Pennsauken

Condo unitowners of Pennsauken, State Farm has you covered.

Insure your condo with State Farm today

Welcome Home, Condo Owners

Are you committing to condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Condo unitowners of Pennsauken, State Farm has you covered.

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

Things do happen. Whether damage from weight of snow, vandalism, or other causes, State Farm has dependable options to help you protect your unit and personal property inside against unanticipated circumstances. Agent Rich Deniken Jr would love to help you set you up with a plan that is personalized to your needs.

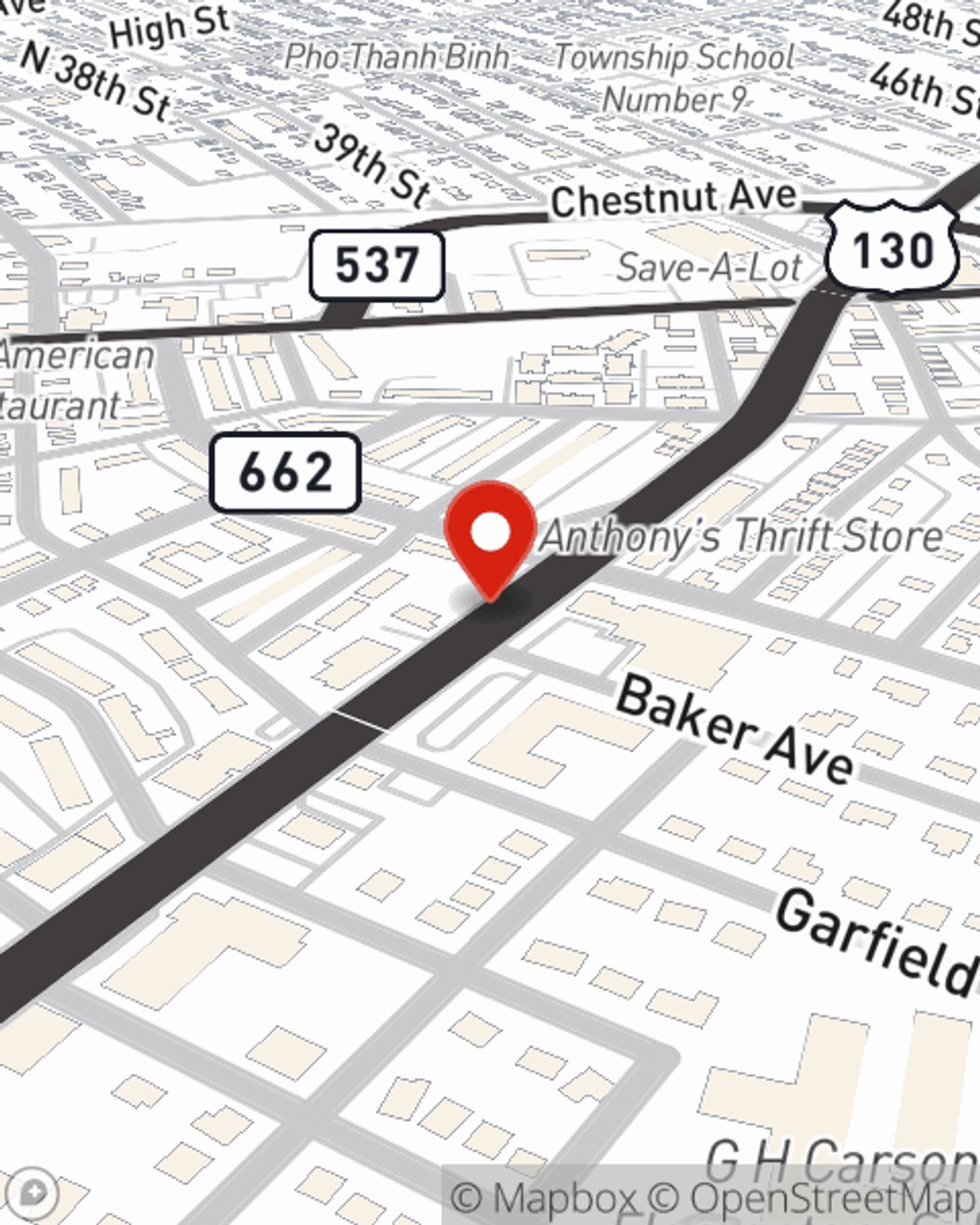

Pennsauken condo owners, are you ready to discover what the State Farm brand can do for you? Get in touch with State Farm Agent Rich Deniken Jr today.

Have More Questions About Condo Unitowners Insurance?

Call Rich at (856) 662-4222 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Rich Deniken Jr

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.